Barter and Today’s Current Marketplace

To understand the decisions around barter and today’s current marketplace, you need to dive deeper into one specific company. With GolfNow’s acquisition of EZLinks, the company now controls 90+% of the third-party tee time market and a majority of the public golf course Point of Sale’s market.

That market position has grown because of key acquisitions and that strength is a major component that golf course owners and operators need to be aware of.

Golf Now:

GolfNow (“GN”) started as a tee-time distributor. They aggregated golf course inventory and sold it online. They did not provide an array of technology tools; they were simply a distribution company. For one barter tee-time per day, you could access a national network that would help sell your tee-times.

They had agreements with every major Point of Sale system in the industry, so that when a round was booked thru GolfNow.com, that reservation would go straight to the golf courses tee-sheet seamlessly. At the time, Point of Sale companies could have chosen to not allow GN to gain access to those integrations. GN, to its credit, negotiated contracts with these Point of Sale companies so that they could operate as a reseller for golf courses. The allowance of this open access, by the Point of Sale companies, is the foundation GN was built on.

In 2011, GN made the strategic decision to pivot and enter the technology space. As a distribution company, GN had no long-term contracts with golf courses. Golf courses could leave – if and when they wanted.

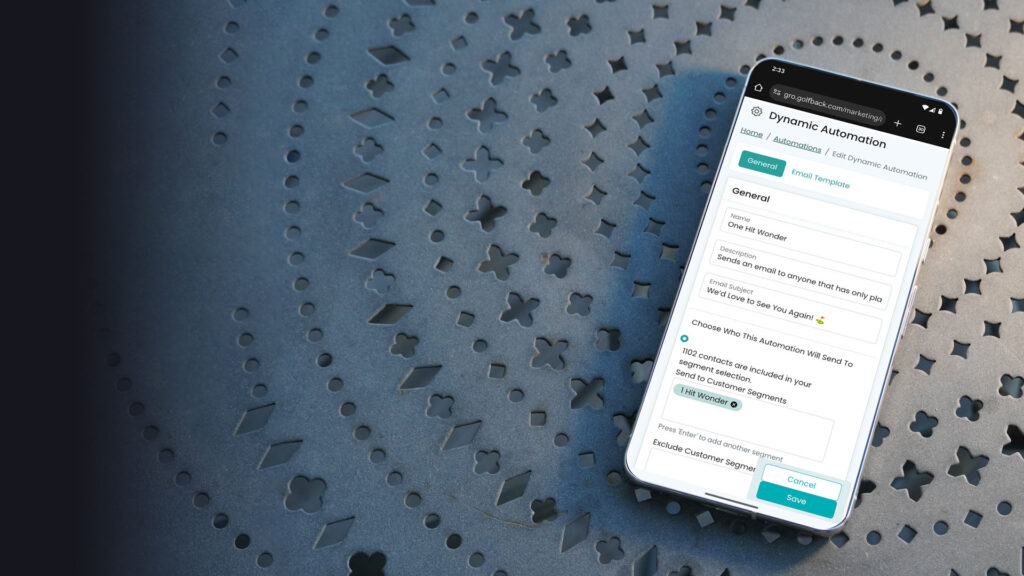

Technology afforded them the ability to get golf courses into contracts, and in turn, gave GN a long-term commitment. They started by building websites, mobile websites and course specific web applications. What was the cost of the technology? Unlike the other website companies in the space charging a monthly cash payment, GN continued to offer barter.

I would encourage all owners/operators to ensure they fully understand any trade time or barter language within any agreements they may have signed. GN was able to strengthen its ability to move trade by offering these new products to operators. Operators, in exchange, gave more flexibility in trade or barter language and thousands of operators, who perceived more value with additional products, obliged.

Is a trade time really a trade time?

If you are a course owner or operator and you are currently bartering or trading one, two or three times per day to any business for services, it is essential to understand the details and financial impact around that trade commitment. Is it simply a tee time per day? Meaning is it one specific time that is available and whether it is sold or not is solely the inventory of the company you are working with?

Or are there other parameters which extend additional benefits or liquidation opportunities? I would encourage all operators to fully understand the inputs of any barter/trade relationships they enter with any third party. The specifics of that language, with all companies, are essential to understanding what inventory commitments you are truly making as an owner/operator. It is my opinion, that the golf courses I work with and have leased have not understood this interrelation.

Many of the Point of Sale vendors, that were GN partners, also made websites for golf courses. It was no secret, at this point, that GN would continue to move down the tech path and enter the Point of Sale space.

It made sense, considering the POS tee-sheet vendors would have a say in allowing GN to integrate when their initial agreement ran out. Some Point of Sale companies, like Club Prophet, choose not to renew the integration terms with GN. I give Club Prophet a lot of credit. They are one of the only Point of Sale companies who said we are not willing to renew our integration because you are a competitor.

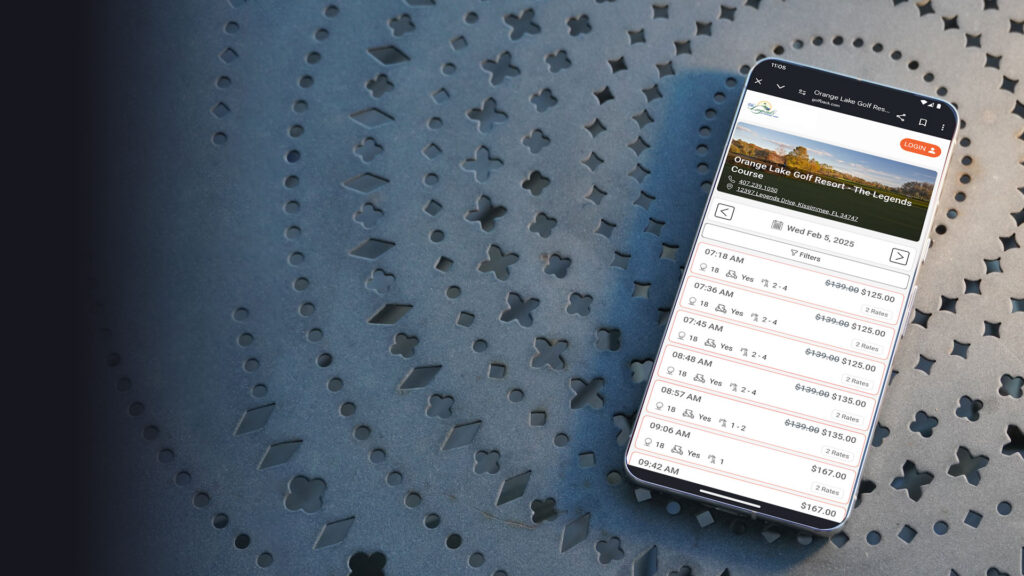

In 2013, after attempting to launch their own Point of Sale system developed in-house, G1, GolfNow purchased FORE reservations. For an additional commitment of trade, you could now have GN distribution, and GN’s tools- which included point of sale, tee-sheet, website and various other tools.

Over the years, GolfNow has broadened their offerings and business with the acquisition of multiple companies in the golf industry sales, marketing and technology arenas. With each acquisition they increased their footprint as far as the number of clubs and more importantly they increased the inventory they could sell. They have also increased their offerings and asked for more trade in exchange for additional products and services.

EZLinks (“EZ”), GolfNow’s main competitor, had deployed a similar strategy in recent years. The counterpart to GolfNow.com was EZLinks owned TeeOff.com which partnered with the PGA tour prior to the acquisition by GN. Both companies provided similar products through a barter model in which you gain access to their products by allowing them to list bartered inventory on their third-party tee time outlets GolfNow.com and TeeOff.com.

When GolfNow announced its acquisition of EZLinks, it was a move that spoke volumes. With this acquisition, GolfNow controls over 90% of the third-party tee time market and a majority of the public golf course Point of Sale market – www.golfincmagazine.com/content/nbc-acquires-ezlinks-take-control-90-tee-time-market

This move allowed GN:

- Increased network of golfers by absorbing EZLinks golfer database

- Assumed control of EZLinks tools to expand product offerings

- Eliminated their largest competitor

- Expanded its trade inventory

One of the largest impacts of this purchase was that it allowed GolfNow to own the barter agreements that EzLinks had constructed. If you are currently an EZLinks client and signed an EZLinks barter agreement, typically that barter would have been listed on the EzLinks owned TeeOff.com.

The new reality is that your barter may be listed on both TeeOff.com and GolfNow.com. If GN was willing to publicly commit to only listing EZLinks barter on TeeOff.com I think that would go a long way in restoring consumer confidence in the original agreements that golf courses believed they were entering. I do not anticipate that happening, but I think it would be a great step by GN.

So why is this so valuable?

The reason is GolfNow’s sell through rates or conversion rates (conversion rates = percentage of tee times sold versus inventory available) are likely significantly higher than TeeOff.com.

This is because of GolfNow’s superior size, scale and reach. With the acquisition of EZLinks they have grown that size, scale and reach; and, if they take the approach of listing barter inventory in two platforms it will ensure a much stronger ability to liquidate agreed upon trade. As operators, we can be assured that any value we saw in unused inventory on GolfNow.com or TeeOff.com will be largely mitigated in the future if a trade time is listed on both outlets. Club owners/operators who entered into EZLinks barter agreements, agreed to trade for services, did so with the intention of that trade being listed on TeeOff.com.

Is it reasonable for those owners to take issue with their inventory being listed on both TeeOff.com and GolfNow.com? Is GN willing to consider the position of their customers as it relates to this concern – time will tell. I believe it is a reasonable position to take that most EZLink customers who entered EZLinks agreements, did so with the intention of liquidating trade in EZLinks outlets.

With GolfNow’s new size, scale and reach they have pivoted tremendously from their days of relying on Point of Sale companies to give them open access or an open integration into their tee sheets for easy booking.

If the Point of Sale companies would have denied this access to GolfNow.com originally, we would be looking at a much different golf technology landscape. This was the very principal their business was built on. Is that same open access available to a company that wants to work and integrate with GN owned systems today?

If the golf courses hand is now forced to use GolfNow’s tools because the tools they may want to use do not integrate with the GN network would that be fair? Or would that fly in the face of the access GN needed when it was building its company?

If GN were willing to provide this open access to other companies that would speak volumes to their desire to offer golf course owners the maximum flexibility to operate their business in a way they feel is the most advantageous. That would speak to their commitment to improving the golf course owner/operator’s business.

One question will tell you a lot!

As a course owner or operator who is exploring its sales, marketing and technology options there is one question that provides the litmus test when evaluating all Point of Sale companies.

That question is “does your Point of Sale Platform and Tee sheet provide an open integration?”. If the answer is yes, you will always have the flexibility to partner with companies that you feel are helping your business.

You will not be in a position where you have to select and choose your partners based on who has negotiated access to a company’s Point of Sale system.

In Closing:

I am a fan of the profit that GN has built. They have achieved impressive results and impacted our industry at every turn. You cannot deny the machine they have constructed. As a person in business, you can see they have made many good decisions for their business.

My question is, has that model provided value for you the golf owner and operator? A complete understanding of a club’s total green fee, cart fee and range revenue impact is essential for an owner/operator to make effective decisions about the companies they partner with. That understanding is ultimately your autonomy as an owner/operator.

If you understand the interrelation of your decision making and your golf revenues you will create a better business. With a foundational understanding of Brown Golf and some information about GolfNow, we are now ready to discuss how we can continue to elevate our industry and take our golf back.