Golf's Top Revenue Optimization Platform

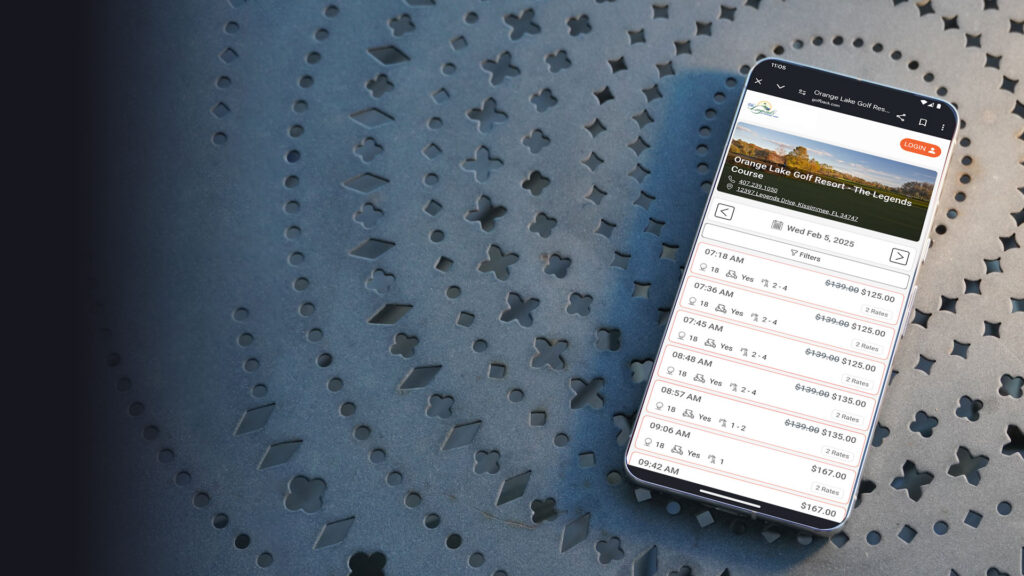

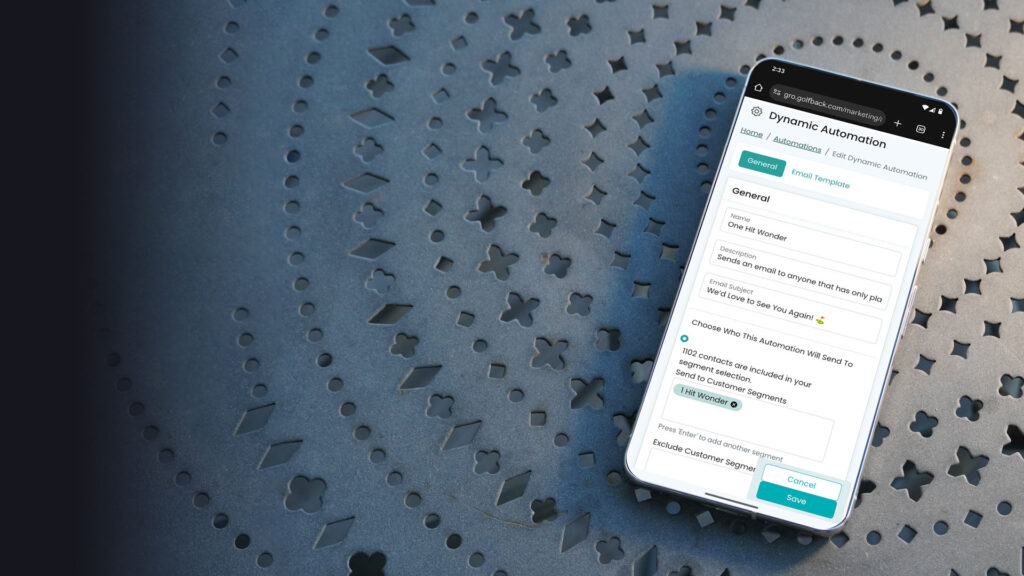

Take Back Your Revenue Customers Brand Data Time Golf

GolfBack helps courses grow revenue by maximizing direct tee time bookings, get more done through automated marketing and helps to reduce reliance on third-party marketplaces